On the 1st day of opening, the mega LIC IPO (initial public offering) has performed as expected, with bidders from all categories rushing to book the issue. According to NSE data, the IPO (initial public offering) from the Life Insurance Corporation of India (LIC) was subscribed 67 percent on 1st day of its opening. The LIC IPO (initial public offering) is an offer for sale of nearly around 221,374,920 equity shares, via which the selling stakeholder — the government of India — looks to collect approx Rs 21 thousand crores to fulfill its targets of divestment for the recent financial year.

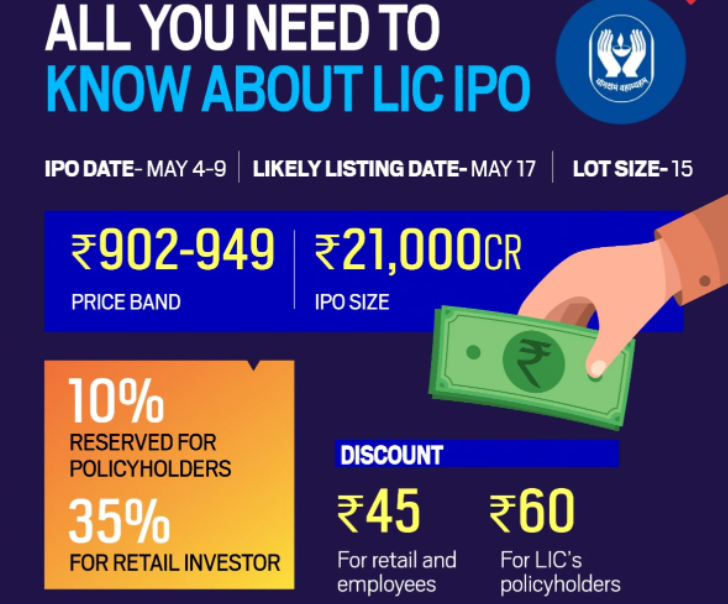

On 4th May, the LIC IPO (initial public offering) opened and the shares will be up for bidding till 9th May, when the government of India is offloading a 3.5 percent stake in the company. The IPO (initial public offering) will remain open on 7th May, (Saturday) between 10 am and 7 pm, NSE stated in a notification on Wednesday. The IPO (initial public offering) price value band has been set, which is from Rs 902 to Rs 949 per equity share, with discounts for many categories.

LIC IPO Subscription Status Today

As reported by NSE data, policyholders booked nearly about double of the portion allotted LIC IPO for policyholders, subscribing to 4,40,31,225 shares or 1.99 percent against 2,21,37,492 shares, as of 1st Day. The quota of employees was subscribed 1.17 times when retail investors booked nearly about 60 percent of their portion. The bid of non-retail investors for approx 27 percent of the portion meant for them, while the bid of QIBs for about 33 percent of the shares was set aside for them. A total of nearly about 10,86,91,770 shares received bids against approx 16,20,78,067 shares up for sale.

Some FAQs:

When did LIC IPO open?

The popular initial public offering (IPO) from India’s largest insurance company named Life Insurance Corporation of India (LIC) which is available for subscription on Wednesday, 4th May 2022, was subscribed by nearly around 90 percent so far on the 2nd day.

What is the IPO price of LIC?

The Indian Government (GoI) has set the LIC IPO price band from ₹902 to ₹949 per equity share mentioning a Rs 45 discount for the LIC employees and a Rs 60 discount for the policyholders applying for the public issue. The public issue will be opened for bidding up to 9th May 2022.

What is the status of LIC IPO?

LIC IPO Latest Updates: The price value band of LIC IPO has been set from Rs 902-Rs 949 per share and the Indian government targets to raise nearly Rs 21,000 crore by selling approx 22.13 crore (22,13,74,920) shares or 3.5 percent of its stake.

What is the lot size of LIC IPO?

There are 15 shares in 1 lot. An Investor is able to bid the maximum 14 number of lots or a price value, which is not excessive of Rs 2 lakh. That means investors are able to bid on only 14 lots (15X14 shares). That means 210 shares for a price value of Rs 1,99,290. On 17th May 2022, LIC shares or IPO will start trading on the stock exchanges (NSE and BSE).

What is the GMP of LIC IPO?

As reported by the market observers, LIC IPO GMP today is Rs 60. That means the grey market is anticipating that the LIC IPO listing will be nearly around Rs 1009. That is approx around 6.50 percent higher LIC IPO price value band of Rs 902 to Rs 949 per equity share.

Can I buy LIC shares?

Yes, you can purchase LIC shares. If you have a Demat account and a PAN, then you can bid for the LIC IPO. For the retail category, the company (LIC) has allotted as much as 35 percent of the total shares, under which policyholders get 10 percent. The employees will get 0.7 percent and the general retail investors will get 24.3 percent of the shares.

Is LIC a good investment?

LIC provides an excellent opportunity for investors at a reasonable price. LIC, alone, is bigger than the entire mutual fund industry of India. As of 30th September 2021, LIC (Life Insurance Corporation) had a total AUM (assets under management) of nearly Rs 39 lakh crore. That is larger compared to the AUM of the overall mutual fund industry in India. Hope now you can understand whether the LIC IPO good or bad for you.

Is it worth applying for LIC IPO?

As reported by some market observers, today’s LIC IPO grey market premium (GMP) is 85. That is nearly around 8 percent higher compared to the LIC IPO price band which is Rs 902 to Rs 949 per equity share. As the grey market (GMP), analysts and observers are already bullish on the IPO from LIC as they all find it a worthy choice for the investment of long-term.

Can I apply IPO on Sunday?

Yes, you surely can apply for an IPO on Sunday if you are applying online through ASBA. This facility can allow people to subscribe for IPO on any day of the week and any time during the application window. The window was opened at 10 am on the 1st Day and will close at 4 pm on the last day of the window. But, any IPO application would be processed on the next working day. Therefore, please make sure that you have sufficient time for the application to be processed.

Can I apply IPO after 5pm?

Yes, you definitely can apply for an IPO after 5 pm if you are applying online through ASBA. That facility can allow you to subscribe for IPO on any day and time of the week during the application window is active.

When can you sell IPO?

IPO trading begins with the opening time of the market on listing day. So you can not sell IPO at this moment. Therefore you can sell the IPO shares at or after the starting of the session of the normal trading on listing day.

In this article, we shared some information regarding LIC IPO. If you have any questions about LIC IPO, then leave a comment in the following comment section. We will answer your every question as quickly as possible. We will publish more news on LIC IPO in the near upcoming future. Read more news on RX 6650 XT Hellhound on our website.

Sources: news18, LIC IPO Discount only for Policyholders, 5th May 2022.